International Tax Planning: Expert Assistance for NRIs

With this increasingly connected world becoming a flight-away destination, we are not bounded to a place nor does our businesses. So as we transverse, we face different aspects of experiences and one thing which follows everywhere is – taxation. But don’t worry, there is a support for you to handle this – International Tax consultant.

Whether you’re globe-trotting or expanding your business abroad, they’ll help you with expatriate tax solutions, so you can focus on what really matters. Let’s turn tax headaches into smooth sailing together!

Know About International Taxation

International taxation is a specific area of tax law that deals with the difficulties posed by cross-border transactions and the tax liabilities that may occur when an individual or organization is liable for taxes in multiple jurisdictions.

As we discussed, in our increasingly international world where people and companies routinely conduct business across national lines, understanding taxation for expats is the need of the hour.

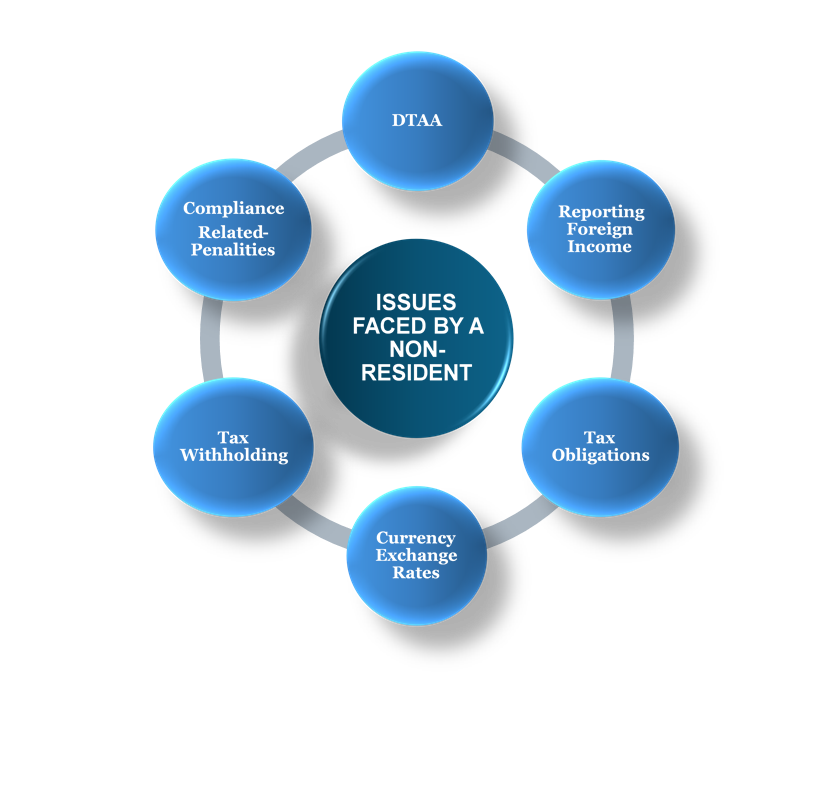

Taxation Challenges Faced by Non-Residents

We’ve identified some common anecdotal issues faced by our non-resident clients before they seek global tax advisory services.

A. Understanding Tax Obligations: Non-residents often struggle to grasp the complex tax rules that apply to their situation. Different countries have different laws regarding taxation of income, and non-residents may find it challenging to understand these nuances however these are manageable with the advice of international tax experts.

B. Double Taxation: Non-residents might be liable to pay taxes in both their home country and the source country so to avoid the dispute of the taxing rights so we have double taxation avoidance agreements (DTAAs) to mitigate this risk. Unfortunately, misinterpreting treaty provisions can lead to overpayment or underpayment of taxes. This is discussed in greater detail in later part of this blog.

C. Filing Requirements: Non-residents might have to file tax returns in multiple jurisdictions, which can be burdensome. Ensuring compliance with all relevant tax laws requires a good understanding of each jurisdiction’s requirements.

D. Income Sourcing Rules: Determining which income is sourced from the country where the non-resident is earning can be tricky. Different countries have different rules about what constitutes income sourced within their borders. The Section 9 of Income-tax Act, 1961 (herein referred as “the Act”) addresses this in India.

E. Tax Credits and Deductions: Non-residents might not be eligible for certain tax credits or deductions available to residents. Understanding what benefits they can claim and what they are ineligible for can be a challenge.

F. Tax Withholding: As per the Section 195 of the Act, non-residents must ensure that taxes are correctly withheld on their income from Indian sources.

G. Currency Exchange Rates: Tax calculations often require converting income and expenses into the local currency. Non-residents must keep track of exchange rates and ensure accurate conversions for tax reporting. However, the Rule 115 of the Income-tax laws provides for the rate of exchange of foreign currency into Rupees.

H. Compliance and Penalties: Section 270A of the Act provides for penalties for underreporting or misreporting of income, also requiring non-residents to meet reporting obligations to avoid penalties. Furthermore, Section 271 of the Act deals with penalties for non-compliance of notices or failure to file returns.

Legal Framework for Non-Residents in India

For the purpose of the NRI Taxation, it is essential to delve into the key legal aspects governing taxation. The issues are being dealt in detail below:

1. Definition of Non-Resident:

According to Section 2(30) r.w.s Section 6(1) of the Act, an individual is classified as a Non-resident if the below mentioned conditions are not satisfied-:

- If he/she is in India for less than 182 days during the financial year.

- If he/she is in India for less than 60 days in a financial year and have been in India for less than 365 days in the preceding four years.

2. Taxation of Non-Residents:

According to Section 9 of the Act, taxation of income of Non-residents in India is based on the origin of the income that is either:

- Earned or received in India, or

- Deemed to Accrue or arise in India.

This includes:

| Head of Income | Details | |

| I | Salaries: | In respect of services provided in India. |

| II | Income from Property: | Rental Income from property located in India. |

| III | Income from Capital Gains: | Gains from the sale of capital assets (Property, shares or mutual funds) situated in India. |

| IV | Income from Business or Profession: | Income from business activities or professional services conducted in India or controlled and managed from India. |

| V | Income from other sources taxed in India: | Like Income from bonds issued by Indian entities, like government bonds or corporate bonds and Dividends from shares of Indian companies, received in the Indian Bank except for NRE accounts. |

3. Double Taxation Avoidance Agreements (DTAAs):

India has entered into Double Taxation Avoidance Agreements (DTAAs) with various countries to prevent the same income from being taxed in both countries. These agreements determine the taxing rights for different types of income and can help non-residents reduce or eliminate their tax liabilities in India.

Section 90 and Section 91of the Act deal with relief from double taxation

- Section 90 provides for relief under double taxation avoidance agreements (DTAAs) between India and other countries.

- Section 91 provides relief where no DTAA is in place.

Non-residents should evaluate the relevant DTAA for the specific income to understand its impact on their tax obligations.

4. Transfer Pricing:

Non-residents involved in international transactions with related parties or Associated Enterprises should follow transfer pricing rules as provided under Section 92 to 92F to ensure that transactions between the AE is entered at a price that would be charged between two unrelated parties in a comparable situation.

For instance, if a U.S. Company sells goods/ services to its Indian subsidiary, then the transaction should be at a price if it was to be entered between unrelated parties according to Section 92 of the Act.

What should you do as a Non-Resident?

Managing these tax matters as a non-resident can be complex. No worries, here is a checklist you should follow primarily:

- Determine Your Residency Status: Confirm your residency status based on the criteria provided in the Income Tax Act. This can be a bit confusing, so take the time to understand the specific criteria that apply to you. It is advised to obtain a Tax Residency Certificate (“TRC”) from the relevant tax authorities of the country.

- Review Applicable Double Taxation Agreements: Check whether your country of residence has a DTAA with India. This can greatly impact your tax liability in India.

- Properly Classify Your Income: Ensure accurate classification of your income sources as per Indian tax laws which is necessary to avoid issues and ensure you’re complying with the law.

- Maintain Accurate Records: Good record-keeping, including books of accounts, bank statements, property documents, and receipts for deductions claimed, not only helps in accurate filing but also provides support in case of any queries from the tax authorities.

- Tax Returns on Time: Non-residents need to file their tax returns in India on time if their income goes beyond the exemption limit. Timely filing helps in keeping your financial matters in good order.

- Seek Professional Advice: Given the complexities of international tax regulations, it’s wise to seek advice from an international tax consultant who specializes in overseas tax consultation. They can offer personalized guidance and help you with understanding of Indian tax laws, ensuring you comply fully while optimizing your tax situation.

Managing international tax issues can be tricky due to the multitude of laws. However, with Master Brains’ cross-border tax services and strategic international tax planning, you can stay ahead and make the most of your global pursuits. Let’s make it easier together and turn those tax challenges into straightforward wins. However, with the expert cross-border tax services offered by Master Brains and some thoughtful international tax planning, you can effectively manage your tax obligations and achieve peace of mind.