IBC 2016 REVAMPING CORPORATE INSOLVENCY STRUCTURE

IBC 2016 REVAMPING CORPORATE INSOLVENCY STRUCTURE

The common perception has long been that insolvency signals the end of the road for a company — a point of no return leading inevitably to a court-mandated dissolution of the enterprise. Creditors and lenders are left to salvage whatever they can from the remnants of a once-thriving business. However, this bleak outlook on insolvency is rapidly changing, thanks to the Insolvency and Bankruptcy Code (IBC), 2016, in India.

Just like not all heart attacks lead to death, similarly the IBC has proven that not every insolvency will lead to liquidation. Instead, many find a path to recovery, emerging from the process as healthy, viable enterprises once more.

In developed nations, bankruptcy is not seen as a corporate death sentence but rather as a phase in the lifecycle of a business that, with the right legal and financial frameworks, can be navigated successfully. India’s adoption of the IBC aligns with this modern approach to insolvency and bankruptcy.

Insolvency and Bankruptcy Code (IBC) of 2016, is designed to consolidate the legal framework for insolvency and bankruptcy, ensuring a time-bound resolution process. By simplifying the path to resolution, the IBC encourages companies to proactively address financial distress, seeking intervention before it’s too late.

This shift towards a more constructive and pragmatic handling of insolvency has not only given companies the chance to reset and rebuild but also provide creditors with a clearer, more orderly mechanism for recouping losses.

SUCCESS STORIES OF IBC

1. Essar Steel was in debt of over Rs 50,000 crore. Under the IBC, Arcelor Mittal was selected as the successful bidder for Essar Steel, and the resolution plan was approved by the NCLT.

2. RCom, which was in debt of over Rs 46,000 crore, was also resolved under the IBC. The resolution plan was approved by the NCLT in 2019, and Reliance Jio acquired the company’s assets.

3. DHFL was in debt of over Rs 90,000 crore. Under the IBC, Piramal Group was selected as the successful bidder for DHFL, and the resolution plan was approved by the NCLT in June 2021.

HOW IBC WORKS?

The Insolvency and Bankruptcy Code (IBC) ensures the resolution of insolvency within a set timeframe. When a debtor fails to repay, creditors take control of the debtor’s assets and decide on the steps to be taken to resolve the insolvency.

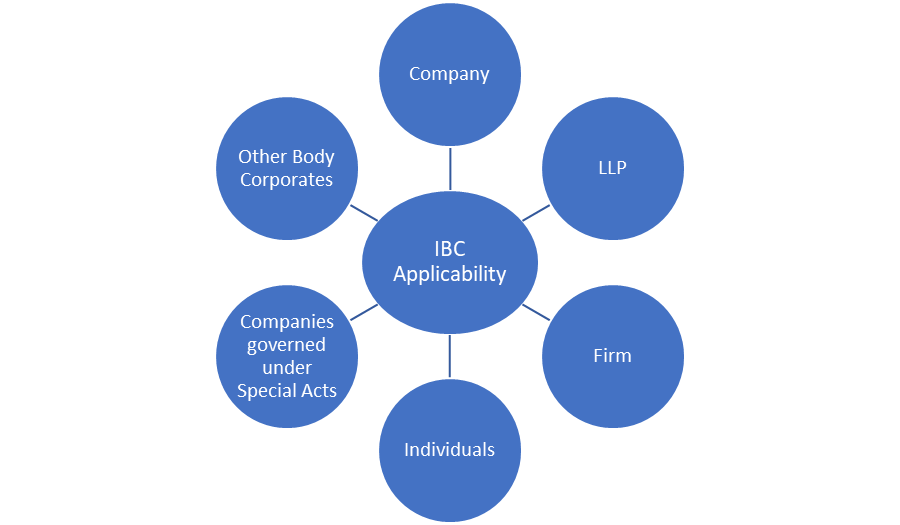

APPLICABILITY OF IBC

This Act shall apply to the following in relation to their insolvency, liquidation, voluntary liquidation or bankruptcy: (Section 2 of Insolvency and Bankruptcy Code, 2016).

WHO CAN INITIATE INSOLVENCY PROCEEDINGS?

INSOLVENCY RESOLUTION PROCESS

1. Application to the NCLT

- A creditor (financial/operational) or the company itself approaches the NCLT to initiate the Corporate Insolvency Resolution Process (CIRP) for the company.

- Creditors must show that the company has failed to pay debts exceeding 1 crore rupees.

- Financial creditors must submit proof of the default, while operational creditors must first demand repayment of their unpaid debt.

- The NCLT must accept/reject the application within 14 days.

2. Moratorium and Public Announcement

Once an application is accepted, the Adjudicating Authority must:

- Declare a moratorium as per Section 14 of the IBC, 2016

- Make a public announcement about the start of the CIRP and invite claim submissions as per Section 15 of the Code.

- Appoint an interim resolution professional (As per Section 16 of IBC, 2016)

3. Appointment of Interim insolvency Resolution Professional

When a corporate debtor enters the CIRP, its board of directors is replaced, and management is handed over to an independent “Interim Resolution Professional” (IRP).

4. Moratorium

The moratorium lasts for 180 days from the application’s acceptance date or until a decision on the repayment plan is made, whichever is earlier. During this period:

- All ongoing legal actions or proceedings related to any debt are paused.

- Creditors cannot start any new legal actions regarding any debt.

- The debtor is prohibited from selling, transferring, or encumbering any assets or rights.

5. Time-limit for completion of insolvency resolution process

- The CIRP must finish within 180 days from when the application is accepted. However, if the committee of creditors agrees, the resolution professional can ask the Adjudicating Authority for more time. The Authority can extend the process for up to an additional 90 days.

- The CIRP should complete within 330 days from insolvency commencement date, including any extension granted.

6. Committee of Creditors

- After gathering all claims against the corporate debtor and assessing their financial situation, the interim resolution professional will form a committee of creditors (CoC) which includes all the financial creditors of the corporate debtor. (as per Section 21(1) of the IBC, 2016.

- Any decisions by the CoC must be made with 51% majority. (Section 21(8) of IBC, 2016).

7. Appointment of the Resolution Professional

The CoC selects an independent individual to serve as the “Resolution Professional” for the duration of the CIRP. It can be the same person who was the interim resolution professional or a new appointee, as per CoC’s discretion.

8. Appointment of Transaction Auditor

Regulation 35A of the IBBI (Insolvency Resolution Process for Corporate Persons) Regulations, 2016 (‘CIRP Regulations’) requires the resolution professional to form an opinion on transactions covered u/s 43, 45, 50 and 66 by 75th day, make determination on such transactions by 115th day, and file an application before the Adjudicating Authority by 135th day of the insolvency commencement date.

To identify such transactions, the Insolvency Professional has the power to appoint a Transaction Auditor.

9. Acceptance of the Resolution Plan

- A resolution plan must be approved within 180 days from the commencement of CIRP by creditors.

- After approval from CoC, the resolution professional submits it to NCLT for final approval.

- Once the NCLT approves the resolution plan, it becomes binding on the corporate debtor, its employees, members, creditors, guarantors, and all stakeholders involved.

- The resolution professional must obtain all legal approvals for the plan within one year of its approval.

10. If the Plan is not accepted

- If the NCLT rejects the approval plan or if the Resolution Plan is not submitted in the prescribed timeframe, liquidation process will commence. The CoC must appoint a liquidator who will dispose of the corporate debtor’s assets and distribute the proceeds among the stakeholders.

The IBC, 2016 has revolutionized the Indian financial ecosystem by ensuring time-bound resolution of insolvency cases, enhancing creditor rights, and improving the ease of doing business.

CHOOSE MASTER BRAINS CONSULTING FOR COMPREHENSIVE IBC CONSULTANCY SERVICES

At Master Brains Consulting, we streamline the Insolvency and Bankruptcy process, ensuring swift, compliant resolutions. We guide you through the intricacies of the IBC 2016, offering clear, strategic advice tailored to your unique situation.

In addition to our B2C services, we offer professional B2B support to boutique firms seeking to outsource their projects related to the Insolvency and Bankruptcy Code (IBC).

This partnership is designed to enhance your firm’s capabilities by leveraging our specialized expertise in IBC matters.

Get in touch with us for comprehensive IBC Consultancy services which include:

- IBC Advisory

- Identification of IRP/RP

- Vetting of Resolution Plans

- Representation before NCLT/NCLAT

- Preparation & Representation before authorities for Personal Guarantors of a Corporate Debtor under Insolvency or Liquidation Proceedings

- Transaction Review for Investigation under IBC

Call/WhatsApp us at +91-8595867402, or send your inquiries to www.masterbrains.co.in

FAQS

1. Who is a Financial creditor under IBC, 2016?

Financial Creditor is defined u/s 5(7) of IBC, 2016. “Financial Creditor” means any person to whom a financial debt is owed and includes a person to whom such debt has been legally assigned or transferred to.

Some common examples of financial creditors include banks, NBFCs, Financial Institutions.

2. Who is an Operational creditors under IBC, 2016?

Operational Creditor is defined u/s 5(20) of IBC, 2016. “Operational creditor” means a person to whom an operational debt is owed and includes any person to whom such debt has been legally assigned or transferred.

Some examples of operational creditors include suppliers, vendors, employees, and service providers.

3. Who is a Corporate Applicant as per IBC, 2016?

Corporate Applicant is defined u/s 5(5) of IBC, 2016.

“Corporate Applicant” means:

- Corporate debtor; or

- A member or partner of the corporate debtor who is authorized to make an application for the corporate insolvency resolution process

- An individual who is in charge of managing the operations and resources of the corporate debtor; or

- A person having the control and supervision over the financial affairs of the corporate debtor.

4. Who is a corporate guarantor?

According to Section 5(5A) of the Code, “Corporate Guarantor” means a Corporate Person who is the surety in a contract of guarantee to a Corporate Debtor.

5. What is the threshold limit for making an application for insolvency and liquidation of corporate persons?

The insolvency and liquidation provisions for corporate debtors apply if the default amount is ₹1 lakh or more. The Central Government can increase this minimum default amount up to ₹1 crore. As of 24.03.2020, the minimum default amount has been raised by the Government to ₹1 crore. For pre-packaged insolvency resolution processes under Chapter IIIA, as of 09.04.2021, the minimum default amount is set at ₹10 lakh.

6. What are the eligibility criteria for appointment of an Insolvency Professional as a Resolution Professional for a corporate insolvency resolution process?

As per Regulation 3 of IBBI (Insolvency Resolution Process for Corporate Persons) Regulations, 2016,

To be eligible as a Resolution Professional for a corporate insolvency process, an insolvency professional must be independent of the corporate debtor. This means:

- They qualify for appointment as an independent director on the corporate debtor’s board if it’s a company.

- They are not related to the corporate debtor.

- In the past three financial years, they haven’t been an employee, owner, or partner of the corporate debtor’s audit or cost audit firms, or of any legal or consulting firm that did business with the corporate debtor worth over 5% of the firm’s gross turnover.