BUILDING BUSINESS DREAMS THROUGH FRANCHISING

BUILDING BUSINESS DREAMS THROUGH FRANCHISING

The franchise model in India is considered a promising and low-risk business model, making it an attractive option for entrepreneurs looking to start their own business with the support of an established brand. For franchisors, the Franchising Model offers an opportunity to expand their business with minimum capital and operational risk.

The growth of the franchise business in India is attributed to factors such as the country’s expanding consumer market, increased disposable income, and the rising demand for branded products and services.

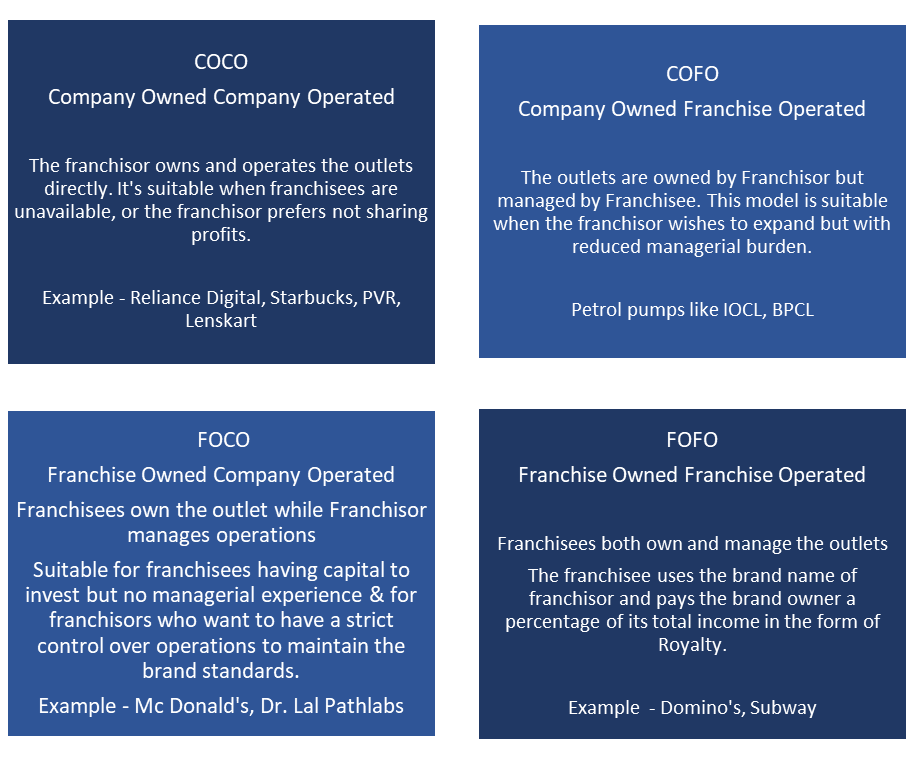

TYPES OF FRANCHISE BUSINESS MODELS

Check these four most popular types of Franchise Models through which big brands are expanding their presence in India:

UNDERSTANDING THE FRANCHISE MODEL WITH THE HELP OF A CASE STUDY

FOFO Franchise Model is the most popular for quick expansion. Let us understand it in an easy way. FOFO involves a franchisor (a company with an established product or service) granting a license to a franchisee (an individual or group) to conduct business using the franchisor’s brand, products, and operational model. In return, the franchisee pays certain fees and agrees to comply with various terms and conditions set by the franchisor.

Case Study: Domino’s Pizza In India

Domino’s Pizza entered the Indian market through a master franchise agreement with Jubilant FoodWorks Limited in 1996.

- Investment and Setup: Franchisees invested in the setup costs (infrastructure, equipment, etc.) and were responsible for the day-to-day operations.

- Training and Support: Jubilant Food Works provided extensive training and support to ensure standardization in service and product quality.

- Revenue Model: The revenue for the franchisor came from the franchise fees, royalty fees, and supplies of certain proprietary ingredients. Major revenue for the Franchisee came from sale of Pizzas and other products such as desserts, breads and beverages. Catering and bulk orders for events and businesses can be a significant revenue source, especially in commercially dense areas.

- Expenditure Model: Expenses of a Domino’s Franchise partner include franchise fees, ingredient costs, and labour wages. Significant outlays also include rent, utilities, marketing, and equipment maintenance.

A Win-Win for Franchisor and the Franchisee

- The franchise model enabled Domino’s to rapidly expand its brand presence and penetrate new markets without substantial capital investment. This growth strategy allowed Domino’s to become one of the most recognized and widespread pizza chains globally.

- Franchisees benefitted from operating under the Domino’s brand, which is globally recognized for quality and service. They could capitalize on the established business model, marketing strategies, and customer loyalty that Domino’s had already built, leading to a potentially lower risk of business failure compared to starting an independent business.

TYPES OF FRANCHISE BUSINESS MODELS OPPORTUNITIES IN INDIA

India offers a wide range of franchise business opportunities across various sectors. Some of the popular franchise models in India include:

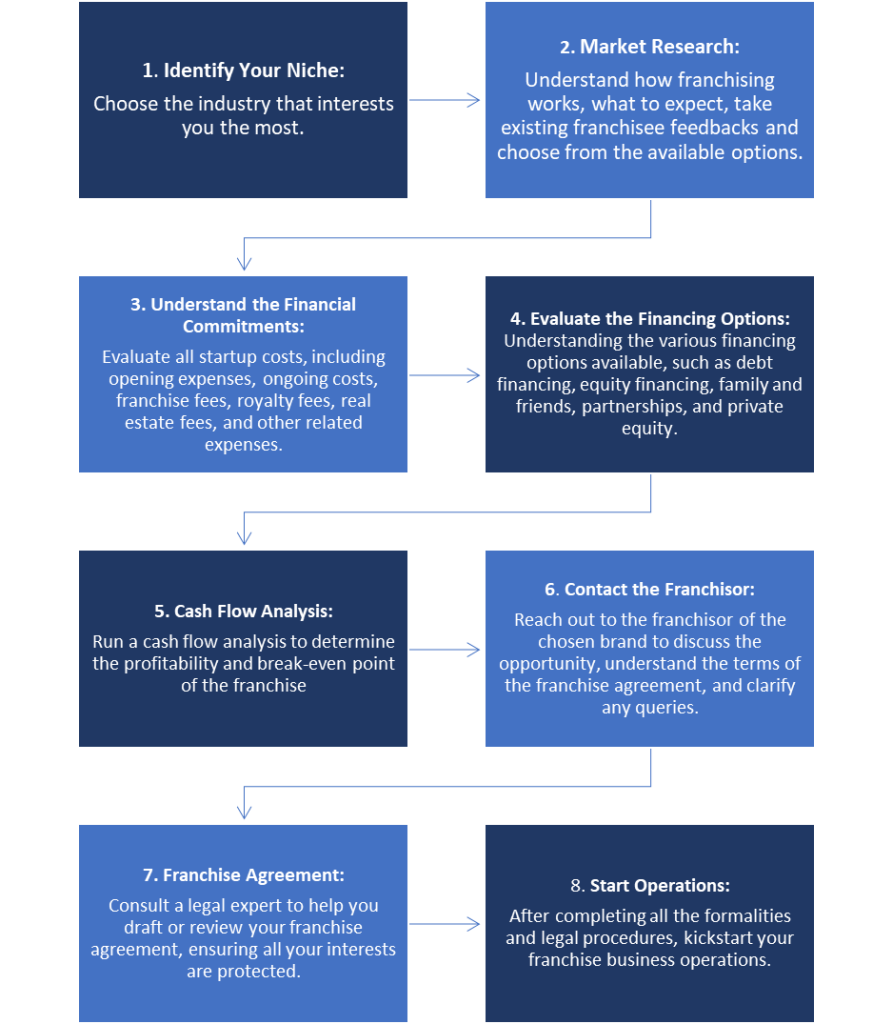

THINKING ABOUT INVESTING IN A FRANCHISE? HERE’S HOW YOU START

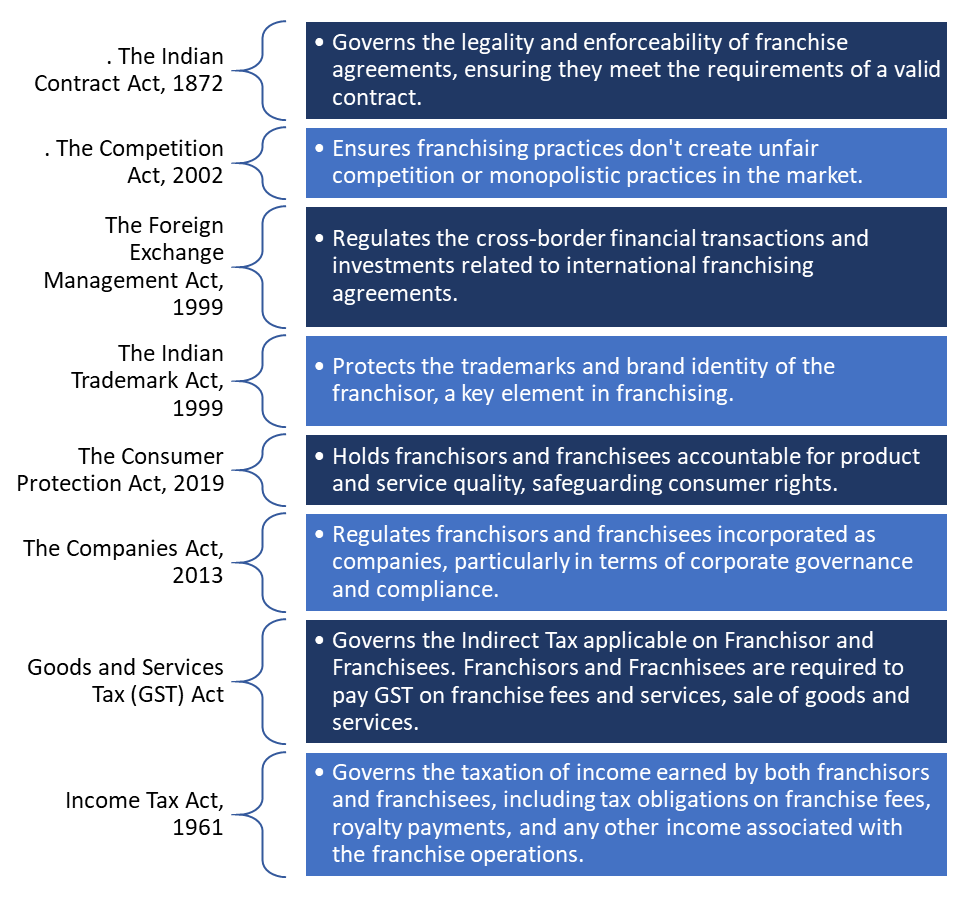

FRANCHISE REGULATIONS IN INDIA

In India, there is no separate legislation to govern Franchise Business. But there are various legislations to protect the rights and interests of both franchisor, franchisee, and consumers in franchisee business. All these laws govern different aspects of franchisee business.

CONTRACTUAL AGREEMENTS FOR FRANCHISES

Having sound legal documentation is essential in case of Franchising business to avoid disputes.

Have a look at the types of documentation that are applicable in franchise business:

1. Master Franchise Agreement:

This agreement is between the Franchisor and the Master Franchisee. A Master franchisee holds the rights to create additional franchises within a specified area.

2. Franchise Agreement:

The Franchise Agreement takes place between the franchisor and the franchisee outlining the rights and obligations of both parties, use of the franchisor’s brand, business model, operational procedures, and intellectual property. If there is a Master Franchisee, the master franchisee enters into separate Franchise Agreements with individual franchisees within their designated territory.

3. Non-Disclosure Agreement (NDA):

When a franchisee enters into a franchise agreement, they gain access to a wealth of proprietary information about the franchisor’s business. An NDA ensures that this sensitive information remains confidential.

4. Non-Compete Agreement:

This agreement ensures that the franchisee does not engage in similar business activities within a specific area and duration post the termination of the franchise agreement.

INTELLECTUAL PROPERTY RIGHTS IN FRANCHISING

In the franchising business, intellectual property infringement is a major concern for franchisors as it can result in financial losses, loss of reputation, and legal liabilities.

Franchisors can take proactive measures to protect their intellectual property rights in franchising such as:

1. Registration of Trademarks and Patents:

Registering trademarks and patents helps the franchisor to take action against unauthorized use of their brand and innovations.

2. Clearly Defined Franchise Agreement:

Contractual Agreements in Franchise business should specifically outline the relevant IP, affirming that it is owned by the franchisor. It should set clear boundaries on using the franchisor’s IP and the consequences of infringement.

3. Protection of Trade Secrets and Know-How:

Franchisors must implement policies and procedures to secure their trade secrets and proprietary know-how. NDAs with franchisees and employees can legally bind them to confidentiality.

4. Vigilance and Enforcement:

Continuous monitoring for potential IP violations is key. Franchisors should be prepared to enforce their IP rights through legal channels if infringements occur.

Get Your Franchise Started Right with Master Brains. Our Services Include the Following Expert Offerings:

- Financial Forecasting

- Making a business plan

- Entity Structure Planning

- Franchise Agreement Drafting

- Drafting other contractual agreements for franchise

- Trademark & Patent Registration

- Legal Notice Drafting & Litigation for Intellectual Property Right Infringement or misuse.

- Proactive analysis of all legal and tax implications

- Complete Compliance Support for Income Tax, Company Law, GST, FEMA, IPR etc.

All Under One Roof. For enquiries call/WhatsApp us at +91-8595867402, or fill out our Query Form, our team will promptly get back to you.