DECYPHERING TAXATION OF VIRTUAL DIGITAL ASSETS

1) How virtual assets are taxed under Indian tax regulations?

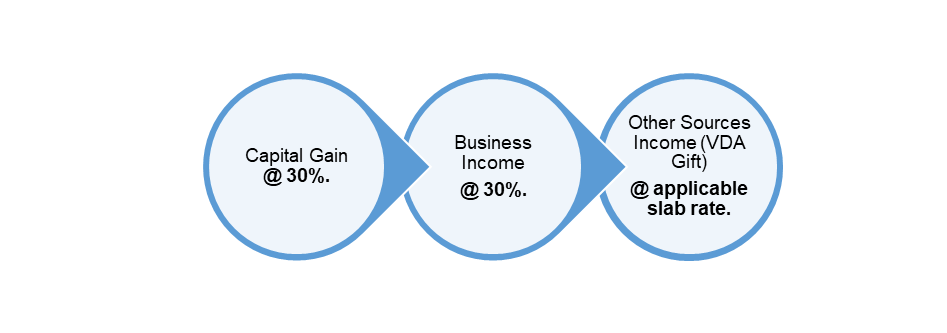

Moving to the most awaited section of this article, let’s navigate the challenging yet exciting tax landscape of virtual assets. The first question that comes to our mind is under which head VDA should be reported. Answering that, it can vary as per the circumstance as under:

As Capital Gain: VDAs are primarily categorized as capital assets under the Income Tax Act, following their inclusion in the definition of capital assets through the addition of Section 115BBH in 2022. So naturally, it will attract the capital gains tax which can be short-term or long-term depending on the holding period however it does not impact the tax rate.

- Short-Term: Holding period of less than 24 months

- Long-Term: Holding period of more than 24 months

To determine your capital gains, subtract the cost of acquisition from the sales price of the VDA. This gain will be taxed at a flat rate of 30%, plus 4% Health & Education Cess and any applicable surcharge.

Additionally, deductions under Chapter VI-A and exemptions under Section 54F are not permitted against such capital gains. Furthermore, resident taxpayers cannot claim relief under Section 87A for VDA income in the new tax regime.

As Business Income: If VDAs are traded frequently as part of a business activity, the income derived may be treated as business income. The gains from virtual digital assets (VDAs) will be taxed the same at a flat rate of 30%, with no deductions for expenses or allowances plus applicable surcharge and cess.

As Gift under other sources: Through the Finance Bill 2022, VDA has been added to the list of gift properties in Section 56(2)(x). Therefore, if someone receives a virtual digital asset as a gift for free or for inadequate consideration and the value of this benefit exceeds ₹50,000, the recipient will treat it as taxable income as the gift law (categorized as income from other sources) and it will be taxed according to the rate applicable to the individual.

What to do with the losses?

Section 115BBH(2)(b) stipulates that any losses incurred from the transfer of a virtual digital asset cannot be offset against any other income.

Additionally, losses incurred in a given assessment year cannot be carried forward to be used against income in subsequent assessment years.

Furthermore, losses from one virtual digital asset cannot be used to offset gains from a different virtual digital asset.

2) Section 194S- the TDS Cornerstone

| Deductor | Deductee | Time of Deduction | Tax Rate | Threshold limit | Overlap with 194-O | Applicability |

| Any person required to pay a resident | Resident Person | Credit Or Payment whichever is earlier. | 1% | Specified Person- ₹ 50,000 in a Financial Year. Others – ₹ 10,000 in a Financial Year. | Section 194 prevalent | Including but not restricted to sum credit to Suspense Account. |

Specified person means individual and HUF whose:

- Gross Business turnover < ₹ 1 crore in the last Financial Year, or;

- Gross receipts from Professions < ₹ 50 lakhs in the last Financial Year, or;

- No profits and gains of business or profession.

As per the Income-tax Circular No. 13 of 2022 (June 28, 2022), TDS should be deducted on the net amount after excluding GST and service charges.

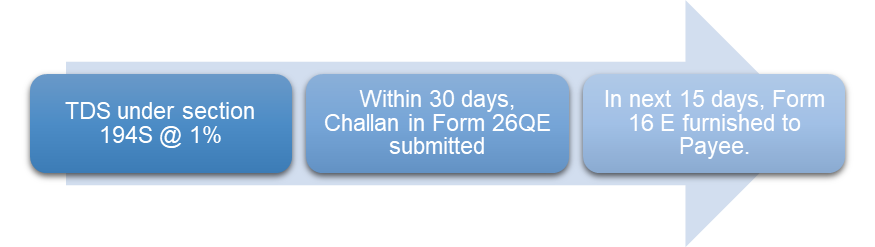

Tax deducted on VDA is to be deposited in challan-cum-statement in FORM 26QE within 30 days from the end of the month deduction made and then furnish to the payee within 15 days the certificate of deduction of tax at source in FORM 16E.

3) VDA Reporting Dilemma?

Let’s see the relevant Income-tax forms:

ITR-2: Use this form if you are an individual or Hindu Undivided Family (HUF) and have income from capital gains or other sources.

ITR-3: Use this form if you are a professional or a business owner, and you have income from VDAs related to business transactions.

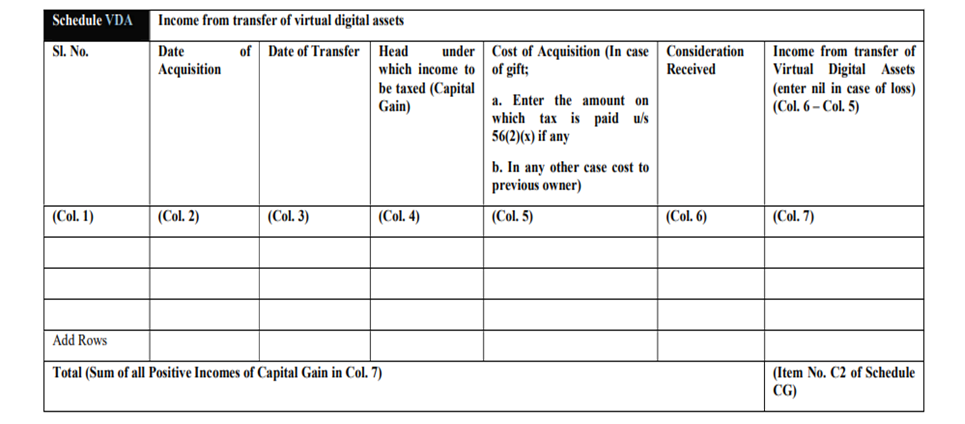

There is a specific schedule dedicated to VDA in ITR form. The key details that you need for reporting Virtual Digital Assets (VDAs) in your tax return:

- Date of Purchase: This indicates the duration for which you owned the VDA.

- Date of Sale: This helps you determine the profit or loss from the VDA.

- Cost of Acquisition: This is the amount you paid to acquire the VDA, crucial for calculating your taxable gain.

- Sale Proceeds: This is the amount you received from selling the VDA, representing your income.

- Head: This shows the selected head of income.

Keep in mind to not fall into the pit of misreporting instances as illustrated below:

- Inappropriate Valuation: If the fair market value of VDAs isn’t determined accurately at the time of purchase or sale, it can result in reporting gains or losses incorrectly.

- Misclassifying VDAs: Incorrectly categorizing VDAs (e.g., treating them as capital assets instead of income) can lead to improper tax treatment.

- Forgetting to Report Foreign Assets: Failing to disclose VDAs held in foreign exchanges or wallets, which is required under Schedule FA of the Income-tax form.

- Not Reporting Gifts or Transfers: Overlooking the reporting of VDAs received as gifts or transferred without consideration, which can trigger tax obligations under Section 56(2)(x).

- Ignoring TDS Compliance: Neglecting to comply with the Tax Deducted at Source (TDS) provisions under Section 194S, especially when dealing with VDAs as a consideration in transactions.

- Failing to Account for Losses: Not utilizing permissible set-offs or carry-forwards of losses from VDAs, which can reduce taxable income.

- Neglecting Documentation: Failing to keep proper documentation of all VDA transactions, which is essential for accurate reporting and for dealing with potential audits.

4) What is the impact of the July Budget 2024 on VDAs?

- Contrasting to the enormous changes in capital gains, no changes were made to the section of TDS and tax rates applicable to virtual assets.

- Even if the classification into short-term or long-term does not matter in the case of VDA, the Finance Bill 2024 has proposed the holding period for assets (other than Listed Securities) to be 24 months to be classified as long-term.

- Under the new rule, a ₹ 10 lakh penalty for failing to report foreign income and assets will only apply if the total value of these assets (excluding immovable ones) exceeds ₹20 lakh.

Therefore, no penalty will be applied when the value is ₹ 20 lakh or below. If the assessee holds foreign assets in the form of virtual assets, this can affect them in terms of reporting and taxation.

5) Is there any GST implication on VDA?

GST is levied on the principle of supply of goods or/and services. As per the GST law, goods are defined as every kind of movable property other than money and securities. This includes products like electronics, clothing, food items, and raw materials.

Basis on this definition, VDAs are categorized as “goods” under GST regulations. This means that transactions involving virtual digital assets are subject to GST, just like other tangible goods.

| Collector | GST RATE | Supply | HSN/ SAC CODE |

| Seller of VDAs who are registered under GST. (Turnover > ₹ 40 Lakhs during F.Y. or voluntarily registered) | 18% | Supply of Goods | 960899 Other miscellaneous article |

| Digital Asset Exchange Platform | 18% | Trading/ Platform fees (OIDAR Services) | 9997 Other services |

Recently, a GST show-cause notice was issued to a cryptocurrency exchange BINANCE by The Directorate General of GST Intelligence (DGGI) with an enormous demand of ₹ 722 crores for collecting fees from Indian customers trading in VDA without GST registration.

The seller can claim Input Tax Credit (ITC) for the following:

- GST Paid on Cryptocurrency, NFT, and Virtual Digital Assets (VDA) Purchases: The GST paid on acquiring cryptocurrencies, NFTs, or VDAs can be claimed as ITC.

- GST Paid on Business-Related Services: GST incurred on services essential for crypto trading operations, such as consultancy services, software expenses, broker commissions and mining costs.

6) Important Circulars & Notifications related to VDA

Reserve Bank of India (RBI) Circulars:

- April 6, 2018: This circular barred banks and financial institutions from engaging in transactions involving virtual currencies, significantly affecting the cryptocurrency market in India. The Supreme Court in the case of Internet and Mobile Association of India (IAMAI) vs Reserve Bank of India (RBI) – 2020 overturned this restriction.

- May 31, 2021: Following the Supreme Court’s decision, this circular allowed financial institutions to resume handling virtual currencies, although it stressed the need for caution and adherence to existing regulations.

Finance Act, 2022:

- Notification dated March 31, 2022: This notification established a new tax framework for VDAs, specifying a 30% tax rate on gains, a 1% Tax Deducted at Source (TDS), and the restriction that losses from VDAs cannot be used to offset other income.

Income Tax Department Notifications:

- Circular No. 13 of 2022 (June 22, 2022): This circular provided detailed instructions on how to tax virtual digital assets (VDAs), including a 30% tax on gains and specific rules for handling losses as set out by the Finance Act, 2022.

- Circular No. 14 of 2022 (June 28, 2022): This circular Outlines TDS obligations for direct transactions between buyers and sellers, not involving an Exchange platform.

Central Board of Direct Taxes (CBDT):

- Notification No. 74/2022 (June 30, 2022): With this notification, the Central Government excluded certain items from the scope of VDA.

Goods and Services Tax (GST):

- Amendment 30 of 2023 (August 18, 2023): This amendment included the same definition of VDA in the CGST Act as it is in the Income-tax Act,1961 and included VDA in the definition of “online money gaming”.

Financial Intelligence Unit – India (FIU India)

- F. NO. 9-8/2023/COMPLU/FIU-IND: Through this notice, FIU India complied with the Central Government notification dated March 7 2023, to extend the Prevention of Money Laundering Act, 2002 (PMLA) to VDA.

In wrapping up, it’s clear that the world of Virtual Digital Assets (VDAs) is both thrilling and complex. As we navigate through evolving regulations and new tax implications, staying ahead of the curve is not just beneficial but essential. The recent scrutiny of cryptocurrency exchanges highlights the need for diligent compliance and strategic foresight.

Embrace the opportunities that VDAs offer while remaining vigilant about legal and financial responsibilities.