Forensic Accountants: The Guardians Against Financial Frauds

In recent years, we have seen many captivating series on financial fraud such as Scam 1992: The Harshad Mehta Story. In between the chaos, you know who are the good guys who emerges as idols of the public for their unwavering commitment to uncovering the truth? They are Forensic Accountants & Investigators. Globally, mammoth of financial frauds and negligence are discovered which eventually causes the death of a corporate entity. This is a staggering issue which is affecting a developing economy like ours.

No worries, forensic accounting team are on the front lines of this war against deceit, utilising their expertise to detect, investigate and mitigate fraud.

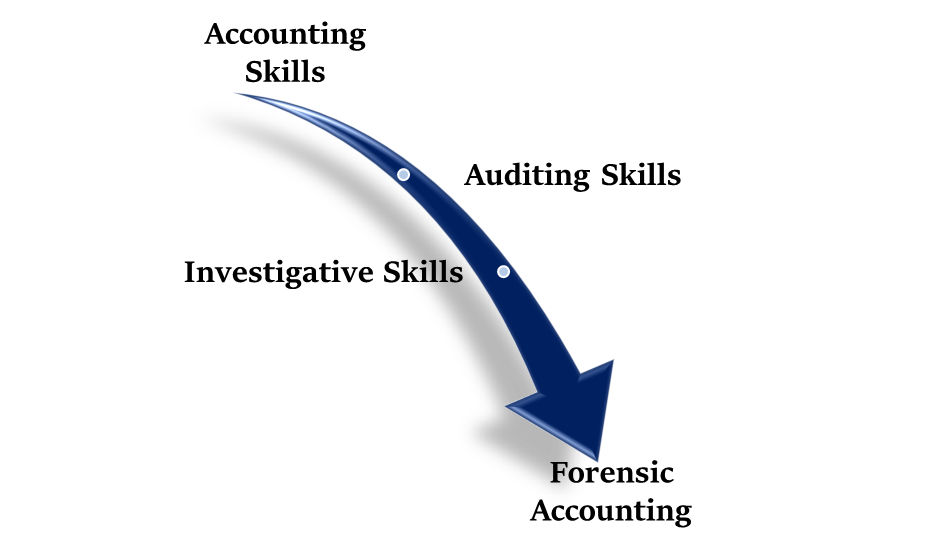

Understanding Forensic Accounting

What is forensic accounting?

Forensic accounting is the process of examining financial records to find out if there has been any wrongdoing, like fraud or theft. Forensic accountants look closely at money matters to uncover the truth and help solve financial disputes. Essentially, they act like detectives for financial problems, using their skills to investigate and report on what they find. Especially, the word “forensic” emphasizes the use of scientific procedures and methodologies to solve legal issue.

Forensic accountants were crucial in uncovering the massive fraud at Enron Corporation. They meticulously analyzed financial statements and transactions, revealing deceptive practices that misled investors and regulators about the company’s financial health.

What Do Forensic Accountants Do?

1. Investigating Fraud

Examining frauds is the prime responsibility of forensic accountants. Financial misconduct can take several forms, including insider trading, embezzlement and financial information deception. These forensic & accounting investigation services focuses on financial records using specific techniques and technologies to find concealed fraudulent actions that could otherwise go undetected.

2. Offering Assistance with Litigation

In court situations, forensic accountants often collaborate with legal teams for litigation support in financial cases. They compile comprehensive reports that provide an overview of their findings and can be very important in court.

3. Conducting Risk Assessments

Forensic accountants conduct risk assessments to help businesses in identifying weak points that might be used to commit fraud. By analysing a company’s financial processes and controls, they provide practical perspectives to safeguard against potential financial crimes.

4. Forensic Financial Reports

Upon completion of their investigations, forensic accountants produce detailed reports summarizing their conclusions with forensic accounting. These reports frequently include visual components like charts and graphs to help clients and legal professionals understand complex financial concepts.

5. Mergers and Acquisitions

Forensic accountants are essential in the field of mergers and acquisitions since they help with due diligence. They evaluate the target companies through financial forensic analysis to look for anomalies or hidden liabilities. This comprehensive review can help acquirers avoid costly errors and make sure they make well-informed judgments.

6. IBC Support

It is often complex to determine the true status of companies which undergo liquidation under the Insolvency and Bankruptcy Code. Forensic accountant work on these transactions to analyse the financial records of the company, identify any discrepancies and uncover potential fraud. They use specialized skills to trace assets, assess liabilities and evaluate financial transactions. This process is crucial in ensuring that creditors receive fair treatment and that any misconduct is addressed appropriately.

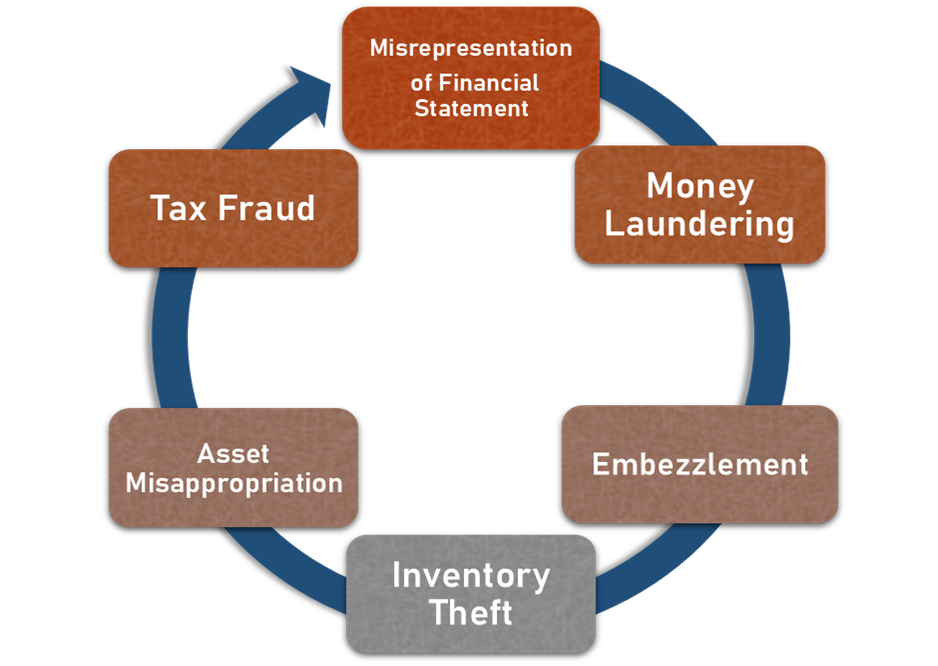

Types of Financial Fraud

Financial fraud can take different forms, and it has serious consequences for individuals and organizations alike.

1. Embezzlement

When an employee embezzles money that their employer has entrusted to them, it is called embezzlement.

An eye-catching example is the PARMALAT controversy in Italy. It was discovered in 2003 that senior executives were complicit in a plot to use dishonest accounting techniques to hide enormous debts, embezzling nearly $20 billion.

2. Money Laundering

Money laundering under the Prevention of Money Laundering Act (PMLA) involves concealing the origins of illegally obtained money to make it appear legitimate, with strict penalties and enforcement by the Enforcement Directorate.

3. Misrepresentation of Financial Statements

This kind of fraud involves purposefully lying about a business’s financial affairs in reports in order to mislead stakeholders or investors.

One of the biggest business frauds in India was the Satyam scandal of 2009. Ramalinga Raju, the company’s founder, acknowledged inflating the company’s earnings and revenues by more than ₹7,000 crores. Later, the manipulation resulted in a severe loss of investor confidence and serious legal harm.

4. Inventory Theft

Inventory theft occurs when employees or external parties steal products or raw materials from a business. This type of fraud can significantly impact a company’s profitability and operational efficiency. For instance, retail businesses often face shoplifting and employee theft, leading to substantial losses.

5. Asset Misappropriation

This involves the unauthorized use or theft of a company’s assets by employees or executives. It can include the diversion of company funds for personal use, theft of physical assets, or misuse of company resources. Such actions can undermine a company’s financial health and trustworthiness.

6. Tax Fraud

Tax fraud includes illegal activities aimed at avoiding paying taxes owed to the government. By underreporting the income, concealing the income sources and inflating expenses are commonly used methods to do so. Tax fraud not only results in financial losses for governments but can also lead to severe penalties and criminal charges for the individuals involved.

Each of these types of financial frauds can have devastating consequences, not just for the organizations involved, but also for employees, investors and the broader economy.

Key Services Offered by Forensic Accountants

A wide range of specialized services are provided by forensic accountants to handle risk management and financial crime.

1. Employee Desktop Forensic Review

When management suspects an employee of financial misconduct, a forensic accountant may perform an employee desktop forensic review. This process involves creating a complete image of the employee’s hard drive, allowing for a thorough examination of all relevant data, including documents and emails. Investigators can uncover evidence of fraudulent activity and guide appropriate action.

2. Department Forensic Analysis

When fraud is suspected within a department or when particular areas are flagged as high-risk, forensic accountants conduct a department forensic investigation. Using trend analysis and data evaluation, forensic accountants review the targeted department. This analysis involves:

- Financial Review: Scrutinizing financial records for any inconsistencies.

- Physical Analysis: Assuring the existence of corporate assets.

- Quantitative Analysis: Analysing data to detect odd patterns.

- Statistical Analysis: Utilizing statistical methods for fraud indicators.

3. Business Forensic Analysis

For organizations looking for a more holistic view, business forensic analysis is essential. Forensic experts evaluate organization’s overall model, processes and internal controls to identify potential fraud risks. The steps include:

- Review of Financials: Examining financial statements and records for accuracy and anomalies.

- Internal Processes Review: Evaluating how well internal controls identify & protect from frauds.

- Quantitative and Statistical Analysis: Assessing performance and identifying any red signs with data analysis tools.

4. Dispute advisory & investigation

Through their investigations, forensic accountants provide profound financial insights, thorough case assessments and proof that can support an organization’s or individual’s legal position in court.

- Case Analysis: A detailed review of the situation to understand the context and implications of findings.

- Proof of Incident: Records that back up the organization’s legal defenses or assertions.

In fact in addition our Master Brains team can also help you identify the right litigation firm for dispute advisory for your case in your budget along with the service of Forensic Accounting & Investigation.

5. Procedure Under the Insolvency and Bankruptcy Code (IBC)

Forensic accountants also investigate transactions undertaken by a ‘company in liquidation’ as a requirement under IBC. This process is guided by sections 43 to 49 of the IBC. Forensic accountants utilize forensic investigation tools to assess the company’s financial activities right before it went into litigation to analyse whether the management has tried to divert any funds into their favour unjustly before going into liquidation. Such investigation also encourages transparency during liquidation by helping corporate debtor & creditors ascertain the company’s actual financial status.

The Right Forensic Accountant

These qualities are needed in a forensic accountant & investigator:

- Experience: Look for a proven track record in handling similar cases, as this can greatly affect the investigation’s success.

- Credentials: Verify qualifications, such as certifications in forensic accounting and memberships in relevant professional organizations.

- Specialization: Choose a forensic accountant with expertise in your specific industry or type of fraud for more effective solutions.

- Reputation: Research their reputation through client testimonials and case studies to assess their effectiveness and professionalism.

The Future of Forensic Accounting

We are experiencing a technological shift fast, which is bringing change to the field of forensic accounting. There is apparent rise in intentional frauds which are not easier to detect. This requires a thorough study and application of advance tools to prevent corporate leaks.

The emergence of big data and sophisticated analytics tools helps in analysing financial data swiftly, uncovering patterns and anomalies that might have previously gone unnoticed.

In the future, the focus will shift on proactive fraud prevention, leading to an increased need for qualified forensic accountants & forensic investigators.

If you or your company suspects a financial fraud in your organisation, let’s join hands for a collective vigilance. Get in touch with Forensic Accountants & Forensic Investigators at Master Brains.