ESG: The Rising Trend Transforming Corporate India

ESG: The Rising Trend Transforming Corporate India

In a visionary move that redefines possibilities. Gautam Adani has transformed a once desolate expanse into the world’s largest renewable energy park. Once devoid of life, the Khadva region of Gujarat bordering Pakistan is now a hub of activity with solar panels, windmills, worker colonies, and desalination plants. Here’s how:

- Adani Group built this massive solar and wind energy park in the remote Khavda region in Kutch district of Gujarat, India, bordering Pakistan.

- Gautam Adani chose to utilize this barren land for generating wind and solar power, recognizing its potential that others had overlooked.

- Spanning over 538 square kilometres, the park is roughly 5 times the size of Paris and can generate 30 GW of clean electricity. Out of this 30 GW, 26 GW is the solar and 4 GW is the wind capacity. Khavda is a promising location for solar and wind energy projects as the region witnesses ~2,060 kWh/m2 of high solar radiation in addition to one of the best wind resources in India, with speeds of ~8 meters per second

- The estimated cost of the project is $2.26 billion

- Energy from Khavda renewable energy park can power 16.1 million homes each year. At its full potential, Khavda will generate 81 billion units’, enough electricity to power entire countries like Belgium, Chile, and Switzerland.

- This project aligns with India’s target of generating 500 GW of clean energy by 2030 and achieving net-zero emissions by 2070.

What is ESG & why is it gaining momentum in India in recent years?

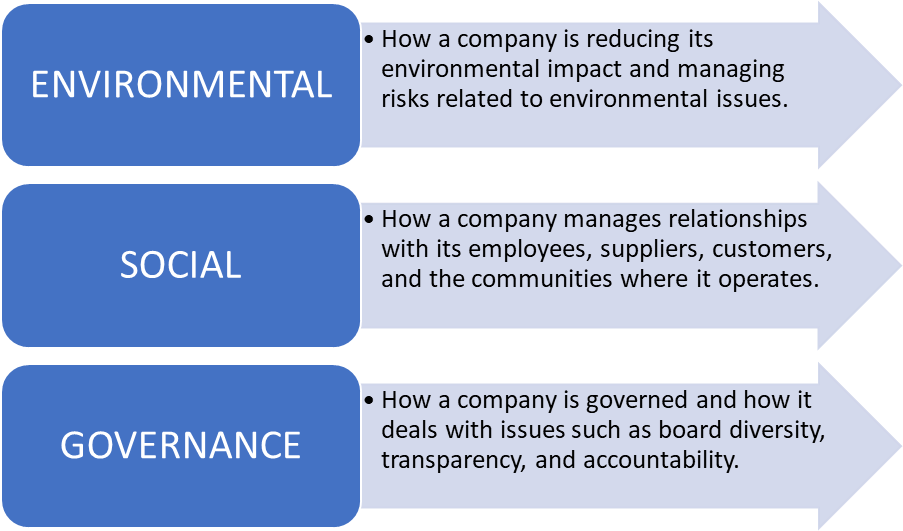

ESG stands for Environmental, Social, and Governance. It is a set of criteria used to evaluate a company’s operations and performance in three key areas:

Together, these criteria help investors and stakeholders understand how a company is managing risks and opportunities related to sustainability and ethical impact, influencing investment decisions and corporate practices towards more responsible and sustainable outcomes.

ESG is undoubtedly gaining momentum in India, with regulatory authorities actively taking initiatives and formulating policies to integrate ESG principles into corporate practices. The primary reasons for the same are:

- Growing awareness of climate change: Governments all throughout the world have been enacting different laws and policies to deal with social and environmental issues. Companies must abide by these rules in order to conduct business lawfully, avoid fines, harm to their reputation, and interruptions.

- Pressure from investors and regulators for companies to adopt sustainable practices: ESG considerations are becoming more and more important to investors all around the world as they make investment decisions. Businesses with strong ESG policies have a higher chance of attracting capital and getting access to it from ethical and sustainable investors.

- Social Impact: ESG investing supports businesses that place a high priority on social issues like community development, diversity and inclusion, labour rights, and gender equality. This has a beneficial societal influence and advances social justice.

Important initiatives taken by Indian regulatory authorities towards achieving India’s ESG goals:

1. Introduction of Green Finance Instruments:

- Green Bonds: Financial instruments designated for the purpose of raising funds for environmental and climate change projects. They support the mobilization of funds from institutional, impact, and retail investors, among others. Green bonds can help finance energy efficiency upgrades, renewable energy projects, and other climate-friendly investments, supporting the shift to a low-carbon economy.

- Green Loans: A green loan assists people, organizations, and governments in obtaining the capital required to support initiatives and businesses that are environmentally sustainable. Both households and businesses can benefit financially from using green loans. Compared to standard loans, green loans frequently have interest rates that are more generous.

- Carbon Pricing: a strategy for lowering emissions of greenhouse gases by pricing carbon. The costs of emissions that are borne by the general public and are linked to their sources by a price, often on the amount of carbon dioxide (CO2) emitted. These costs include harm to crops, medical expenses from heat waves and droughts, and property loss from flooding and sea level rise.

2. India’s Climate Goals and Commitments:

- Commitment to reduce the carbon emission intensity of the economy by 45% by 2030.

- A target to reach 50% cumulative Electric power installed capacity from non-fossil fuel-based energy resources by 2030.

- Creation of a carbon sink of 2.5 to 3 GtCO2e through additional forest and tree cover by 2030

- Aiming for net-zero emissions by the year 2070, announced by Prime Minister Narendra Modi in 2021 in COP 27.

3. Standardization in Reporting:

- Introduction of Business Responsibility Report (BRR) by SEBI for top 100 listed companies by market capitalization. In line with the disclosure requirements arising from the “National Voluntary Guidelines on Social, Environmental, and Economic Responsibilities of Business” (NVGs), SEBI required the top 100 listed entities by market capitalization to file Business Responsibility Reports (BRR) as part of their annual report in 2012. The top 500 listed companies by market capitalization were gradually required to file BRRs in 2015, and the top 1000 listed companies were required to do so in 2019.

- Introduction of framework ‘BRSR Core’ and ‘BRSR Core by SEBI for top 1,000 listed entities by market capitalization. The BRSR framework requires the top 1000 listed corporations and businesses to report on their environmental, social, and governance (ESG) performance and to show that they are committed to using responsible business practices. The workshop also covered a wide range of subjects, including the use of family-friendly policies in business, effective BRSR disclosures, digital tools, IT portals and software for BRSR, and CSR and ESG as tools for building responsible businesses.

The importance of Environmental, Social, and Governance (ESG) regulations is rapidly expanding in India as the focus is shifting towards sustainability. The government sets distinct guidelines for acts related to environmental, social, and governance (ESG) rules. These rules are meant to protect investors from greenwashing while encouraging businesses to implement sustainable policies and practices that will eventually have an ethical and sustainable impact. Environmental, social, and governance (ESG) standards are becoming increasingly relevant as corporate India’s landscape continues to evolve towards sustainability. SEBI and Ministry of Corporate Affairs would be key players in tapping global ESG trends and applying same in India. As corporate India is on the rise, ESG regulations have a long way forward.

𝐑𝐞𝐯𝐢𝐞𝐰 & 𝐄𝐝𝐢𝐭𝐢𝐧𝐠 𝐂𝐨𝐮𝐫𝐭𝐞𝐬𝐲 :

Founder & Managing Partner

DLS Law Offices

Divyanshi Chadha

Manager, Strategy & Business Development

DLS Law Offices