TO JOINT VENTURE OR NOT: EVALUATING KEY ASPECTS

TO JOINT VENTURE OR NOT: EVALUATING KEY ASPECTS

A joint venture is a collaborative effort between two or more entities where the participants agree to pool their resources – financial investment (capital), knowledge, expertise, technology, equipment, or anything else relevant – to achieve a specific goal or complete a particular project. Joint ventures can be temporary, lasting for the duration of a specific project, or they can be established for an indefinite period.

Why are Joint Ventures Formed?

There are many advantages by forming a joint venture:

- Shared Resources and Expertise: By combining their assets and knowledge, participants can overcome limitations and achieve goals that might be out of reach individually. A small organization might partner with a larger one to gain access to critical resources or specialized skills.

- Market Entry and Expansion: A business looking to enter a new market can partner with a local organization to navigate unfamiliar regulations and build relationships. This can be especially helpful for government agencies or non-profits working in new territories.

- Risk Sharing: Complex or expensive projects can be less risky when the financial burden and potential setbacks are shared among multiple partners. This allows for bolder ventures and faster innovation.

Taxation of Joint Ventures

While a joint venture may have some similarities to a limited partnership, for income tax purposes in India, it’s typically treated as an Association of Persons (AOP).

Key points regarding chargeability of AOP as a taxable person:

Section 2 (31) of the Income Tax Act, 1961 defines a ‘person’ which includes an Association of Persons and hence AOP is a taxable entity under the I. T. Act.

| 1. | The Income Tax Act itself doesn’t define AOP. However, court rulings have established that an AOP exists when two or more people join forces voluntarily for a common purpose or action with the intention of generating income. |

| 2. | An AOP is a distinct taxable entity, separate from its individual members. This means the AOP is liable to pay taxes on the income it generates. |

| 3. | The Finance Act of 2002 clarified that an AOP is considered taxable regardless of whether its primary goal is to earn profits. Previously, some entities argued they weren’t AOPs because profit wasn’t their main objective. |

In essence, for tax purposes, a joint venture is likely treated as an AOP if it involves multiple people working together with the specific goal of generating income. This distinction is crucial for understanding how the income generated by the joint venture will be taxed.

Taxation of AOP

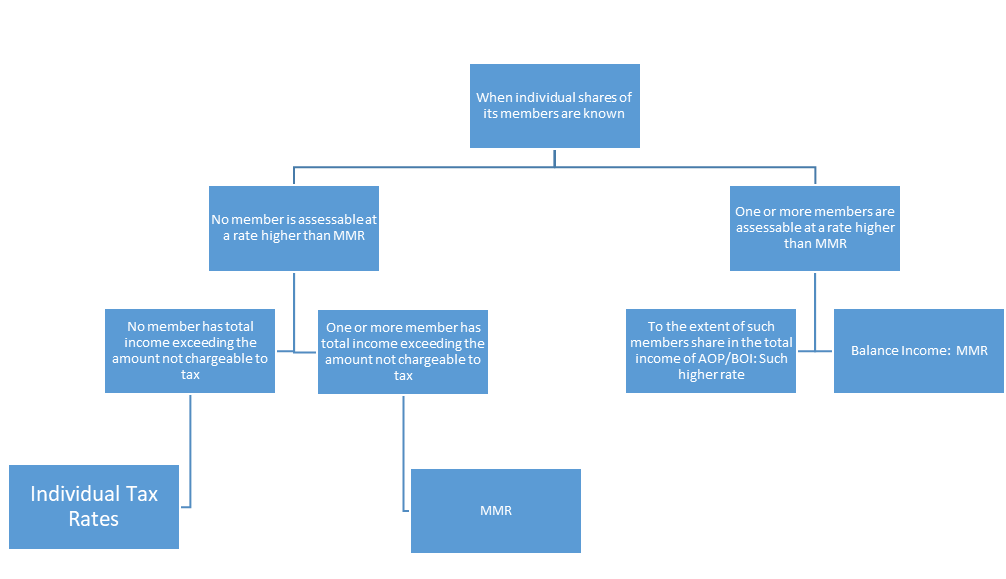

Total income of the AOP is taxable either at the rates applicable to an individual, or at the Maximum Marginal Rate or at a rate Higher than Maximum Marginal Rate.

There can be two situations in case of AOP

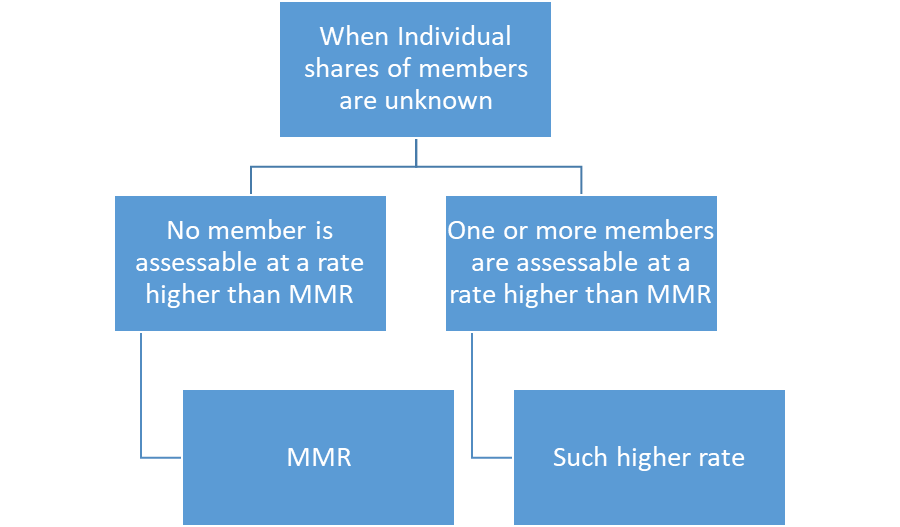

1. When individual shares of its members are unknown

2. When individual shares of its members are known

Tax Rates when Individual shares are unknown

Interest paid by the AOP/BOI to its member (on loan, capital, borrowing) will be disallowed while computing profit and gain from business or profession from the income of the AOP/BOI [Section 40(ba)].

• Salary or other remuneration paid to a member is not deductible even if it is a case of actual services rendered by him.

Tax Rates when Individual shares are unknown

Section 2(29C) defines ‘Maximum Marginal Rate’ as the rate of income-tax (including surcharge on the income-tax, if any) applicable in relation to the highest slab of income in the case of an individual, AOP or BOI, as the case may be, as specified in Finance Act of the relevant year.

While taking total income of a member, to determine whether it exceeds the maximum amount not chargeable to tax for the above purposes, his share in total income of such AOP/BOI shall be ignored.

Taxability of Share of Members

| Section 67A: Method of computing share of member of an AOP | |

| Step 1 | Total income of AOP Less: Remuneration/Interest to Members = Distributable Income |

| Step 2 | Share of member of distributable income Add: Remuneration/Interest from AOP Less: Interest to AOP by member =Member’s share |

| The share of the member in the income or loss of AOP/BOI shall be apportioned under the different heads of income in the same way as the income or loss of AOP/BOI has been computed under each head of income. | |

| Taxation of Member’s share u/s 86 | ||

| If AOP/BOI is taxed at MMR/Higher rate | If AOP/BOI is taxed at rates applicable to an individual (i.e. normal tax rates) | If no income tax is chargeable on total income of AOP/BOI |

| Share of member shall not be included in his total income | Shares of members shall be included in his total income but subject to the provisions of sec 86. | Share of members shall be fully charged to tax. |

| Sec 86- Tax payable by member without education cess x Members share in AOP/BOI u/s 67A Total income of member (including share from AOP/BOI) |

The deductions under section 80-IA or section 80-IB etc. will be available to joint ventures just like an AOP and no share of income fully deductible under these sections would be liable to tax again in the hands of its members.

Partner with seasoned Business Consultants for all your business needs!

Before embarking on your entrepreneurial venture, consult the seasoned experts at Master Brains India to understand the legal, financial, taxation, and operational implications of your chosen entity structure. We make the evaluations for you, following a comprehensive and future-oriented approach, evaluating every dimension to suggest the best course of action.

Make informed decisions from the outset by partnering with Master Brains Consultants. Avoid future pitfalls and position your venture for success.

Connect with us now for a professional consultation. DM us, call/WhatsApp us at +91-8595867402, or send your inquiries to www.masterbrains.co.in